Imagine having the peace of mind that comes with knowing your loved ones will receive the care they need right at home. If you or someone you care about relies on Medicare, understanding how long it will cover home health care is crucial.

You're not alone in wondering about the specifics. Many people face the same questions and uncertainties. This article will give you clear, straightforward answers, helping you feel more confident and informed. By the end, you'll have a firm grasp on what to expect and how to plan ahead.

Your peace of mind is just a few minutes away—keep reading to find out everything you need to know.

Medicare Basics

Understanding how long Medicare will pay for home health care is crucial for many families. Medicare, a federal health insurance program, helps those aged 65 and older. It also supports younger individuals with certain disabilities. Knowing the basics can guide you in planning for your healthcare needs.

Eligibility Requirements

To qualify for Medicare-covered home health care, certain criteria must be met:

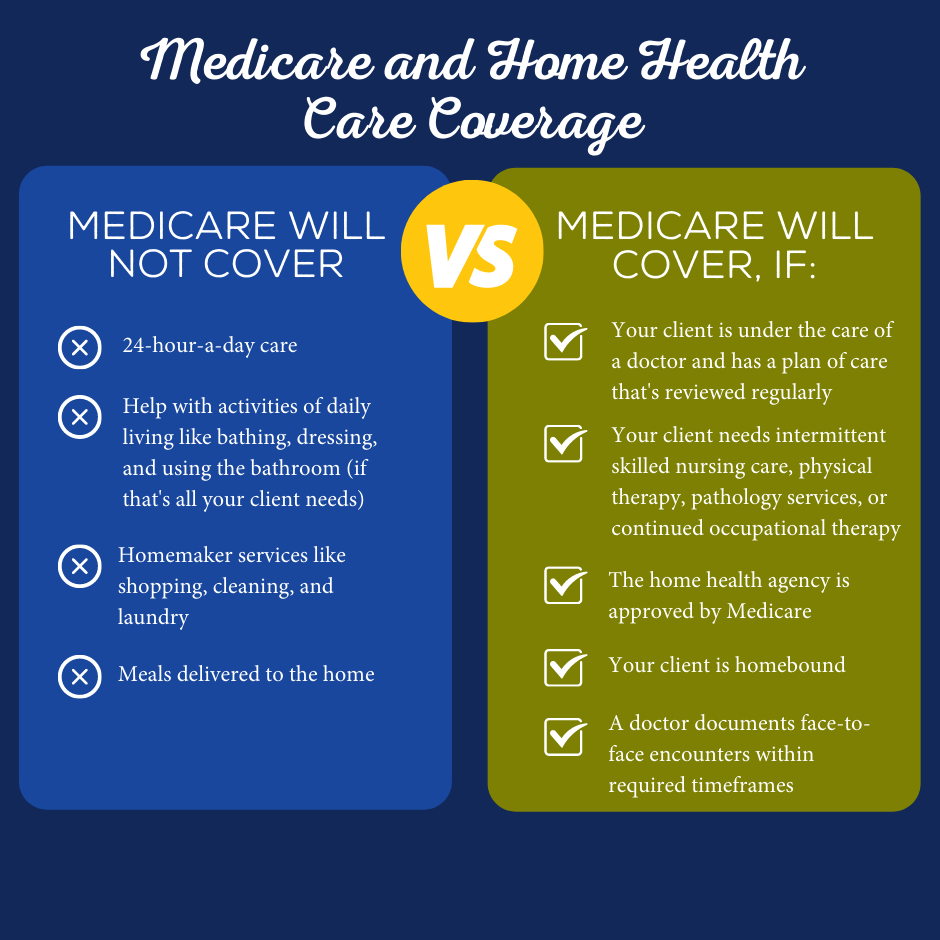

You must be under the care of a doctor, and receiving services under a plan of care created by them.

You must need, and a doctor must certify your need for, one or more of the following: intermittent skilled physical therapy, speech-language pathology services, or continued occupational therapy.

The home health agency caring for you must be Medicare-certified.

You must be homebound, and a doctor must certify that you’re homebound. Being homebound means leaving your home isn’t recommended due to your condition, or you’re unable to leave without the aid of a wheelchair, walker, or other help.

Medicare's coverage for home health care can help manage health needs at home. It's crucial to understand what is covered and for how long. This knowledge ensures you make informed decisions about your healthcare options.

Eligibility Criteria

Medicare offers home health care benefits that many seniors find invaluable. These services help people stay in their homes while receiving the care they need. But how long will Medicare pay for home health care? The answer often depends on meeting specific eligibility criteria. Understanding these criteria ensures you or your loved ones receive the necessary support.

Understanding Medicare's Basic Eligibility Requirements

Medicare covers home health care for beneficiaries under certain conditions. First, you must be enrolled in Medicare Part A and Part B. Additionally, a doctor must certify that you require skilled care at home. This care can include therapy, or other medical services.

Your doctor must also establish a care plan that details the services you need. This plan ensures that the care provided meets your medical requirements. Without this plan, Medicare may not cover the costs.

Homebound Status

To qualify for home health care, you must be considered homebound. This means leaving your home requires significant effort. It can also mean that you need assistance from another person or a mobility device. Medicare requires this status to ensure that home health care is essential.

Need For Skilled Services

Medicare covers home health care if you need skilled therapy services. These services must be necessary to treat your illness or injury. Skilled services include:

Physical therapy

Speech-language pathology services

Occupational therapy

Without the need for skilled services, Medicare may not cover the home health care costs.

Certification By A Doctor

A doctor must certify that you need home health care. This certification is based on a face-to-face meeting with the doctor. The meeting must occur within 90 days before starting the care or 30 days after it begins.

Care From A Medicare-certified Agency

The home health agency providing care must be Medicare-certified. Agencies receive this certification when they meet specific federal quality standards. You can find a list of certified agencies on Medicare's official website.

Duration Of Care Coverage

Medicare typically covers home health care for a limited time. For a standard care plan, coverage may last up to 60 days. This period can be renewed if the need for care continues. A doctor must re-certify the need for care every 60 days.

Types Of Home Health Care

Medicare is a vital program that supports many seniors in the United States. Understanding how long Medicare will pay for home health care is essential. Different types of home health care services offer diverse benefits and coverage. Knowing which type suits your needs can help ensure you receive the best care possible.

Medical Care

Medical care at home can include a wide range of services. Physical therapists might help with exercises to improve mobility. Doctors can provide consultations and monitor health conditions remotely. Medicare often covers these essential services, ensuring you get professional medical attention in the comfort of your home.

Personal Care

Personal care involves assistance with daily activities. This includes bathing, dressing, and grooming. Aides can help prepare meals and ensure safety at home. While Medicare covers medical needs, some personal care services may require additional insurance. It’s crucial to check what’s included under your plan to avoid unexpected costs.

Therapeutic Services

Therapeutic services such as physical, occupational, and speech therapy are essential for rehabilitation. Therapists work on improving function and mobility. Medicare covers these services if they’re prescribed by a doctor and deemed necessary. Regular sessions can aid in faster recovery and improved quality of life.

Social Services

Social services provide emotional support and counseling. These services help patients and families cope with illness or changes in lifestyle. Social workers offer guidance on financial and legal matters related to health care. While important, Medicare may only cover certain aspects of social services.

Covered Services

Medicare is a lifeline for many seniors and disabled individuals, providing crucial support for home health care. Understanding the range of covered services is essential for maximizing benefits. These services ensure that patients receive the necessary care while staying in their own homes. Let's explore the covered services provided by Medicare for home health care.

Therapy Services

Physical, occupational, and speech therapy are essential parts of home health care. These therapies help patients regain strength and mobility. They also assist in improving daily living skills. Speech therapy aids those with communication or swallowing issues. Medicare covers these services when they are part of a certified plan of care.

Medical Social Services

Medical social services offer support beyond physical health. Social workers provide counseling and connect patients to community resources. They also assist families in coping with the emotional aspects of illness or injury. Medicare pays for these services if they help improve your treatment.

Home Health Aide Services

For those needing help with personal care, home health aide services are available. Aides help with daily activities like bathing, dressing, and grooming. These services are covered if they are part of a larger plan of skilled care.

Durable Medical Equipment

Medicare also covers durable medical equipment (DME) needed for home use. This includes items like wheelchairs, walkers, or hospital beds. Medicare pays for these items if they are prescribed by your doctor and deemed necessary for your care.

Other Covered Services

Medicare may cover additional services as part of a home health care plan. This includes medical supplies such as bandages and catheters. These supplies are provided if they are necessary for your treatment.

Duration Of Coverage

Medicare provides a vital service to many individuals who need home health care. But understanding the length of coverage can be complex. Knowing how long Medicare will cover these services helps patients and families plan better. The duration of coverage often depends on specific conditions and regulations. It is essential to grasp these details to make informed decisions.

Duration Of Coverage Under Medicare

Medicare covers home health care as long as certain conditions are met. These conditions include being homebound and needing skilled care. Once these conditions are fulfilled, Medicare pays for services for an initial period. This period is usually up to 60 days. The coverage may extend beyond this period if the patient still needs care.

Initial Coverage Period

The initial coverage period lasts for 60 days. During this time, Medicare covers all approved services. This includes skilled therapy, and other necessary health services. Patients do not pay anything for these services during this period.

Extensions And Renewals

If the patient continues to need care, the coverage can be extended. Medicare requires a reassessment to determine the need for continued care. If approved, the coverage renews for another 60 days. This process can repeat as long as the patient qualifies for care.

Conditions For Continued Coverage

Patient remains homebound.

There is a continued need for skilled care.

A doctor certifies the need for extended care.

Limitations And Restrictions

Medicare provides essential support for those needing home health care. But it's important to understand the limitations and restrictions that come with it. These guidelines determine the extent and duration of coverage. Knowing these rules helps in making informed decisions about care plans.

Medicare home health benefits are available only to those meeting specific criteria. Patients must be under a doctor's care and require skilled therapy. Furthermore, they must be homebound, which means leaving the home is a challenge due to health conditions.

Types Of Services Covered

Medicare covers a range of home health services. These include skilled physical therapy, and speech-language therapy. However, it does not cover 24-hour care or personal care services like bathing and dressing. This can be a significant limitation for some patients.

Medicare does not provide indefinite coverage for home health care. The duration is based on the patient's needs and progress. Typically, services are reevaluated every 60 days. Continued eligibility depends on ongoing medical necessity.

Restrictions On Frequency

There are limits on how frequently services can be provided. Skilled therapy must be intermittent, not constant. This means care is provided fewer than seven days a week or less than eight hours a day.

Financial Considerations

While Medicare covers many home health services, patients may face out-of-pocket costs. Items like durable medical equipment may require a 20% coinsurance. Understanding these costs is crucial for financial planning.

Cost Sharing Responsibilities

Medicare offers coverage for home health care, providing essential support for eligible beneficiaries. Understanding how long this coverage lasts and the cost-sharing responsibilities is crucial. While Medicare Part A and Part B cover home health services, beneficiaries may need to share some costs. Knowing these details helps in planning for healthcare needs effectively.

Understanding Cost Sharing Responsibilities

Medicare beneficiaries must be aware of their financial obligations. These responsibilities can vary based on the type of care received. Home health care can involve different services, each with its own cost-sharing structure.

Medicare Part A Coverage

Medicare Part A covers inpatient care, including some home health services. Beneficiaries generally do not pay for home health care under Part A. The coverage is typically comprehensive, but certain conditions apply.

No deductible for home health care under Part A.

No coinsurance for services under Part A.

Medicare Part B Coverage

Medicare Part B covers outpatient care, including home health services. There are cost-sharing responsibilities under Part B.

20% coinsurance for durable medical equipment.

Annual deductible applies to Part B services.

Managing Expenses

Beneficiaries can manage their expenses by understanding Medicare coverage. Planning for additional costs ensures financial preparedness.

Review Medicare benefits regularly.

Consider supplemental insurance for extra coverage.

Consult with healthcare providers about potential costs.

Process To Access Care

Medicare offers essential support for those needing home health care services. Navigating the process to access this care involves several steps. Understanding these steps ensures eligible beneficiaries receive the care they need. Below, explore the straightforward process to access Medicare-covered home health care services.

To qualify for Medicare home health care, a few key criteria must be met. These include:

Homebound Status: You must be unable to leave home without assistance.

Medicare Coverage: You must be enrolled in Medicare Part A and/or Part B.

Initial Assessment

The first step involves an initial assessment by a doctor or qualified healthcare provider. This assessment determines your specific care needs.

Doctor's Visit: Schedule an appointment to discuss your health condition.

Medical Evaluation: The doctor evaluates your ability to perform daily activities.

Care Plan: Based on your evaluation, the doctor creates a personalized care plan.

Choosing A Home Health Agency

After receiving certification, choose a Medicare-approved home health agency. Consider the following factors:

Factor | Consideration |

Location | Proximity to your home for convenient visits. |

Services Offered | Ensure they offer the specific services you need. |

Reputation | Check reviews or ask for recommendations. |

Initiating Services

Once a home health agency is selected, services can begin. Follow these steps:

Contact Agency: Reach out to the agency to schedule your first visit.

Service Agreement: Review and sign the agreement outlining services and costs.

Care Commencement: The agency starts providing your needed care.

Role Of Home Health Agencies

Medicare can be a vital support for those needing home health care. Understanding its coverage duration and the role of home health agencies is crucial. Home health agencies are essential in delivering personalized care at home. They ensure patients receive skilled therapy, and assistance with daily activities. Their services can enhance recovery and improve the quality of life. Let's explore their role in detail.

Home health agencies play a key role in coordinating patient care. They work with doctors to create personalized care plans. This collaboration ensures patients receive the care they need.

What Services Do Home Health Agencies Provide?

Physical, occupational, and speech therapy.

Home health aides for assistance with daily activities.

Medical social services for emotional support.

Duration Of Medicare Coverage

Medicare covers home health care for a limited time. Coverage depends on the patient's condition and needs. Generally, Medicare pays for up to 60 days if criteria are met.

Criteria For Medicare Coverage

Criteria | Description |

Medical necessity | Services must be prescribed by a doctor. |

Homebound status | Patient must be unable to leave home without assistance. |

Challenges Faced By Home Health Agencies

Agencies often navigate complex regulations. They must ensure compliance with Medicare requirements. This can include maintaining detailed records and adhering to strict guidelines.

Benefits Of Choosing Home Health Care

Convenience of receiving care at home.

Personalized attention tailored to individual needs.

Reduced risk of hospital readmissions.

These agencies provide invaluable services, making them vital partners in patient care. Their commitment to quality care helps patients recover and live more comfortably.

Impact Of Medical Necessity

Medicare offers support for home health care services, but the duration of coverage can vary. A key factor influencing how long Medicare will pay is medical necessity. Understanding this concept can help you navigate the complexities of Medicare coverage.

Medical necessity plays a crucial role in determining the extent of Medicare's support for home health care. This term refers to the need for services or treatments based on a doctor's assessment of a patient's condition. Medicare evaluates whether the care provided is essential for the patient's health and well-being.

Doctors must certify that the patient requires skilled therapy. This certification is necessary for Medicare to continue covering home health services. The patient's health condition must justify the need for such care.

Understanding Medical Necessity Criteria

Medicare has specific criteria to evaluate medical necessity. These include:

Doctor's Certification: A doctor must confirm that the patient needs specialized care.

Care Plan: The care plan should be detailed and outline the services required.

Periodic Reviews: Regular assessments ensure the patient's condition still requires care.

Meeting these criteria is essential for continued coverage. Failing to meet any of these can result in a halt in services.

How Medical Necessity Affects Duration Of Coverage

The duration of coverage is directly tied to medical necessity. Once the care is no longer deemed necessary, Medicare may cease payment for home health services. If a patient's condition improves, the need for skilled care might reduce. This can impact how long Medicare covers the costs.

Regular evaluations are conducted to ensure ongoing medical necessity. These evaluations help determine if the patient's current health status justifies continued care.

Importance Of Documentation

Proper documentation is vital. It provides evidence of medical necessity. Doctors and healthcare providers must maintain detailed records of the patient's condition and treatment plan. This documentation supports the justification of continued Medicare coverage.

Accurate records help in periodic reviews and assessments. They offer a clear picture of the patient's needs and progress, ensuring Medicare coverage is sustained as long as necessary.

Alternatives To Medicare Coverage

Medicare provides essential support for those needing home health care. However, its coverage has limits. Understanding these limits is crucial for planning long-term care. When Medicare falls short, exploring alternative options becomes necessary. These alternatives can offer more comprehensive care and financial assistance. This guide explores various options available beyond Medicare coverage.

Private Health Insurance

Private health insurance can be a valuable resource. It often covers services that Medicare does not. Policies vary, so it's essential to review the specifics of each plan. Many private insurers offer more flexible coverage options. These options can include extended home health care services.

Long-term Care Insurance

Long-term care insurance is designed to cover services like home health care. Policies can cover a range of care needs. This includes both short-term and extended care. Evaluating a policy's benefits is key. Ensure it aligns with your care needs and financial situation.

Medicaid

Medicaid is a government program providing health coverage for low-income individuals. It often covers more home health services than Medicare. Eligibility varies by state. It's important to check state-specific rules and benefits. Medicaid can be a viable option for those who qualify financially.

Veterans' Benefits

Veterans may qualify for additional health care benefits. The Department of Veterans Affairs (VA) offers home health care services. These services may include skilled therapy. It's crucial for veterans to explore these benefits. They can provide significant support for home health needs.

Out-of-pocket Payments

Paying out-of-pocket is an option for those who can afford it. This method offers flexibility in choosing providers and services. Costs can add up quickly, so budgeting is vital. Some may consider using savings or other financial resources. Planning ahead helps manage expenses effectively.

Community Programs And Services

Many communities offer support services for home health care. These programs can include transportation, meal delivery, and personal care. Non-profit organizations often provide these services at low or no cost. Exploring local resources can uncover valuable support options.

Alternative | Key Benefits |

Private Health Insurance | Flexible coverage options |

Long-Term Care Insurance | Covers extended care needs |

Medicaid | More comprehensive than Medicare |

Veterans' Benefits | Specialized services for veterans |

Out-of-Pocket Payments | Flexibility in provider choice |

Community Programs | Support services at low cost |

Frequently Asked Questions

How Many Hours A Day Will Medicare Pay For Home Health Care?

Medicare does not limit the number of hours per day for home health care. Coverage is based on medical necessity. Services are typically intermittent or part-time, as determined by a healthcare professional. Always consult with Medicare or your healthcare provider for specific eligibility and coverage details.

How Long Can A Patient Be On Home Health?

Home health duration varies based on patient needs and insurance coverage. Medicare typically allows up to 60 days per episode, with renewal possible if medically necessary. Private insurance plans may differ, so check specific policy details. Continuous assessment ensures home health services meet evolving care requirements.

How Much Does Medicare Pay For In-home Caregivers?

Medicare generally does not cover in-home caregivers for personal care or homemaking services. It may cover medically necessary home health care, such as skilled therapy services, if prescribed by a doctor. Contact Medicare directly to understand specific coverage details and eligibility requirements for home health services.

Conclusion

Medicare can cover home health care for a limited time. Understanding how this works is important. Check eligibility and coverage details with Medicare. This helps ensure you get the right support. Home health care offers comfort while recovering. It can help you stay independent.

Always explore your options and talk to healthcare professionals. They can provide guidance on services and coverage. Planning ahead makes the process smoother. Remember, health care decisions need careful thought. Make informed choices for your well-being. Your health matters, and proper care makes a difference.