Just as sure as there is a lifespan for human beings there is a natural tendency to ignore planning for one’s later years. The idea of becoming older, possibly depending on others, and plain old fear can all conspire to keep people from taking steps to maintain independence as long as possible, potentially save money, and reduce fear with knowledge.

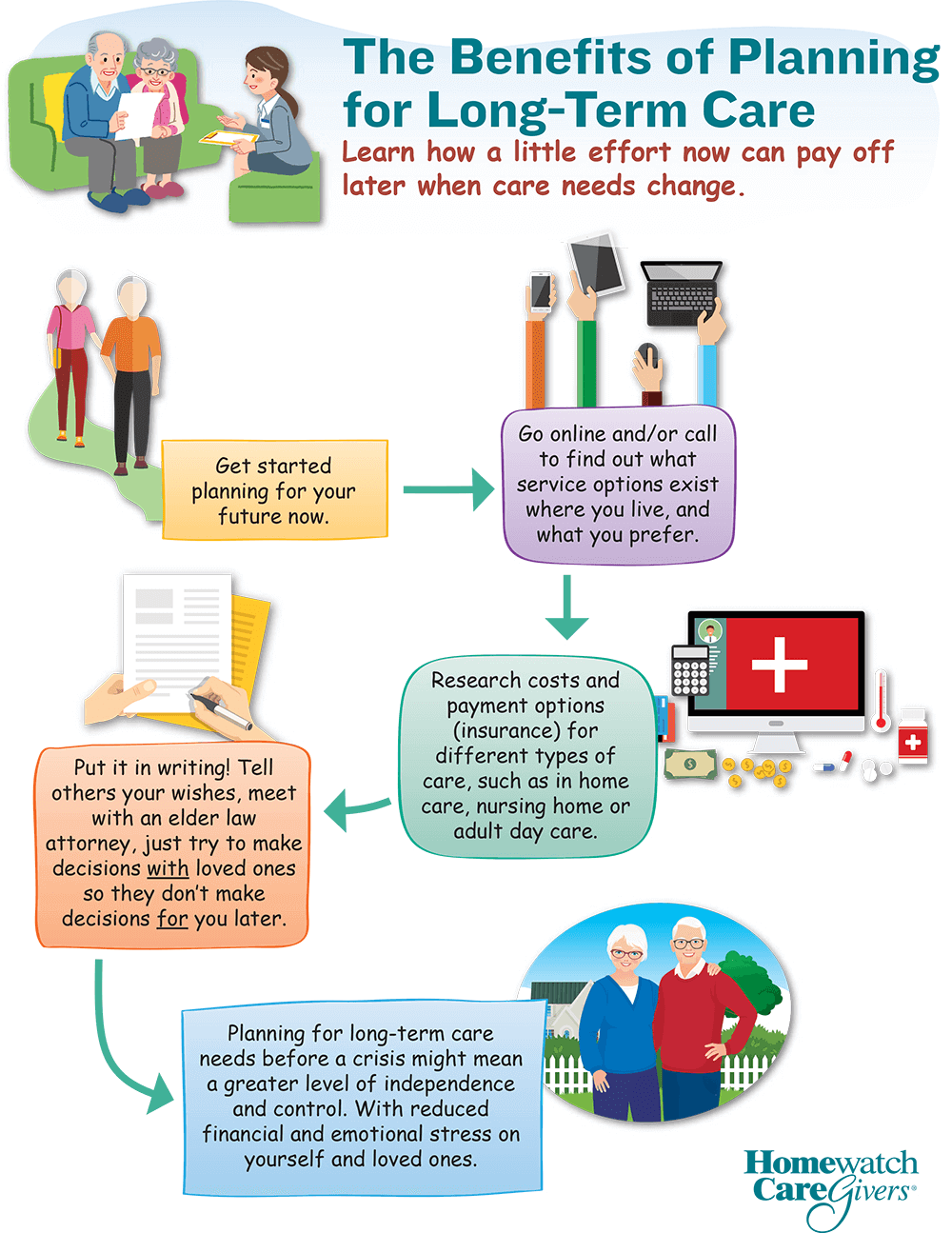

It’s time to plan for the future now so all of your years can be as joyful as possible. Take a look at our flowchart and read below to learn more about long-term care planning.

First Steps

Planning begins with research. Did you know that long-term care costs can vary state to state? The available services will vary depending on where you live too. Researching the costs and options now might lead to other research, planning and decisions such as moving to be closer to family or talking to family about your preferences.

Contact a home care agency (or two or three) to ask about the type of services they offer in your area, call an adult day care facility and ask if you can visit to learn more, and do the same with local assisted living facilities and nursing homes. Did you know that government programs only pay for about 16% of long-term care (according to the National Care Planning Council)?

Once you know the prices and the ways you can pay—private pay, long-term care insurance, veterans’ benefits, or something else--for the services, then you can contact an expert to help you plan for what you prefer. An elder law attorney is a specialist in long-term care planning. You can find one at the National Academy of Elder Law Attorneys, Inc. or ask friends for recommendations.

An elder law attorney may also have connections to other elder care professionals who can help you make decisions about future care and living arrangements.

Next Up

While communicating with professionals about your options is important, it won’t do much good if you don’t get it written down. Each person has unique relationship dynamics so if the day comes when they cannot speak for themselves, it’s key to have their wishes recorded for others to honor as best as possible.

Having a neutral third party—such as an elder law attorney—to document the wishes of a person can mean less stress on the individual and their loved ones later when there is a need for long-term care.

While ideally, each person will remain healthy enough to continue taking care of themselves, accidents and illness do happen at any age and these incidents can change one’s abilities temporarily or permanently. When someone takes their care and planning into their own hands ahead of time it means that they are possibly reducing a financial and emotional burden on those they care most about.

Our flowchart takes you through the steps of long-term care planning for yourself or a loved one.